Contract management software for finance is very important. It helps financial organizations work better and lower their risks. By using contract lifecycle management, businesses can realize the contract management software for finance benefits of making their processes easier, allowing them to focus on strategic tasks. This ensures they follow their contractual obligations and truly forecast their financial commitments.

These solutions create a centralized place for all agreement information. This way, different teams can easily work together. It provides a single source of truth for all agreement data. From creating agreements to getting approvals and digital signatures, Contract management software for finance gives complete control over the contract lifecycle. This helps reduce the risk of errors and makes sure agreements are renewed on time.

Understanding Contract Management in Finance

Contract management software for finance means watching over all parts of an agreement’s life. This starts from making and negotiating the agreement to carrying it out, keeping track of changes, renewals, and ending it. This includes deals with vendors, customers, partners, and employees. A financial contract management solution ensures good management, makes sure rules are followed, lowers risks, and gets the best financial results. It is not just about storing documents; it is about using agreement data for smarter financial decisions.

The Importance of Contract Management

In finance, careful contract management for finance is very important. It affects how healthy an organization’s finances are. First, it helps reduce risk by managing the entire contract process. By keeping an eye on deadlines, deliverables, and obligations, financial institutions can prevent expensive penalties. These penalties come from missing payments, not following service-level agreements, or breaking agreement terms.

Effective contract management improves cash flow. When organizations have clear insights into new agreements and new contracts, payment schedules, and important milestones, they can better anticipate and handle their income and expenses. This ability to predict allows for accurate forecasting, smart investment choices, and better financial stability overall.

Key Components of Financial Contract Management

Effective financial contract management relies on a few important parts. A main part of this is a central repository, a centralized place to hold all agreement data securely. This place should store critical contract information securely, control the different versions, and allow easy access for authorized staff. Keeping all agreement information together makes it simpler to track, audit, and report.

Another important part is automating key tasks. This means creating agreements automatically using approved agreement templates and contract templates. It also includes getting electronic approvals for routing and signing. There are automated reminders for renewals, deadlines, and other contract obligations. By automating these jobs, financial institutions can cut down on manual work. This helps reduce mistakes and speed up contract life cycles, which improves overall efficiency.

Related Article: What is Contract Lifecycle Management? A Quick Overview

How To Streamline And Automate Financial Workflows Using Contract Management Software

To make financial workflows better and easier, use a strong contract management system-designed CLM software for finance. This means putting all agreement data in one safe place. It will give you easy access to important financial details like payment terms, renewal dates, and service level agreements. Use digital signatures to speed up agreement creation and signing. This helps cut down on manual work and lowers the risk of errors. Setting up approval workflows helps you track progress easily. This keeps things under control and improves risk management. Adding CLM helps you improve financial processes and leads to more accurate forecasting.

Identifying Areas for Automation

The first step in using CLM to automate financial workflows is to find areas that need automation. Begin by looking at your current agreement processes. Find any slow spots or tasks that take a lot of time, repeat often, or have mistakes. Some great options for automation in contract management software for finance include:

- Approval workflows: Make it easier to route, review, and approve agreements by using automated approval workflows. This helps follow internal rules and compliance needs.

- Renewal and expiry notifications: Set up automatic reminders for renewals and expirations. This way, you don’t miss deadlines. It helps make sure agreements are renewed or ended on time, avoiding lost revenue because of missed agreements.

- Payment processing: Automate how you handle invoices, payment approvals, and payment reminders based on the agreement terms. This reduces delays and ensures payments are made on time.

Implementing CLM Solutions for Efficiency

Once you find key areas to improve, choosing the right contract management software for finance is very important. You should look for a solution made for the needs of the financial sector. Important features are strong reporting and analytics, tools for compliance, and good security measures. These will help keep sensitive financial data safe.

Choosing a contract management software for finance is just the first step. To get the most out of it, you need to implement it well. This means moving your current agreements into the new system. You also need to set up workflows and user permissions. Plus, give your team thorough training. It is important that your team feels good about using these new tools. If they understand the benefits, they will be more likely to use the system effectively.

Related Article: What is Contract Workflow? Benefits of Automating Approvals

Contract Management Challenges in the Financial Sector

The financial sector has special challenges in contract management. There are many agreements to handle. These often have complicated terms and strict rules to follow. Managing these agreements can feel overwhelming. There is also the risk of errors and changes in regulations. Plus, financial institutions need to keep their agreements secure. These factors add to the difficulties they face.

Common Obstacles and How to Overcome Them

One big problem in contract management software for finance is the risk of errors. When people handle tasks manually, mistakes can happen. This can lead to missed deadlines, wrong payments, or issues with rules and regulations. A CLM solution can help here. By automating tasks, checking data, and keeping track of changes, companies can greatly lower these risks.

Another problem is following new rules and regulations. The finance world is always changing. This means that companies need to keep up with new laws and requirements. CLM systems can help. They provide a central place to manage compliance tasks. They also track changes in regulations. This helps ensure that agreements are always current.

Adapting to Regulatory Changes and Compliance Requirements

The financial industry has many rules that must be followed closely. If businesses do not follow these rules, they can face big fines, legal issues, and harm to their reputation. Contract management software for finance is very important for keeping up with these rules. It offers a centralized repository where all regulatory documents and agreements can be stored and easily accessed.

With tools like automatic reminders for deadline goals and the chance to track rule changes, organizations can stay ahead of their compliance duties. This helps ensure that agreements are checked and updated often to meet current rules. It also lowers the chances of breaking any compliance laws.

Related Article: What is Contract Management? Your Detailed Guide

CLM: A Smart Solution For Efficient Contract Management for Finance

A strong Contract management software for finance can change how things work. contract management software for finance takes care of the whole agreement process. This includes everything from making agreements to renewing and ending them. It cuts down on manual work and makes things more accurate. Let’s look at the key features of contract management software for finance and how it fits well within financial operations.

Features That Make CLM Stand Out

Contract management software for finance tools offers several features to make contract management easier. Cloud storage allows you to access agreements from any place. This makes it simple for different teams to work together. Version control features keep track of all changes made to an agreement. This creates a clear record and helps prevent confusion from having several versions.

Intuitive interfaces help users find their way around the system, look for agreements, and create reports easily. This makes it simple to learn and helps more people in the organization use the system. Features like automated reminders for important dates, such as renewal dates or payment deadlines, help stop missed deadlines and possible money losses.

Integrating CLM into Your Financial Operations

Integrating contract management software for finance with your current financial operations is very important to get the most out of it. This usually means linking the contract management software for finance with other key business tools. These tools include Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and accounting software.

This integration helps different departments achieve seamless collaboration and work together smoothly. It breaks down data barriers and gives an overall view of agreement data. When information is shared across platforms, organizations can understand agreement performance better. They can spot trends and make informed choices.

Related Article: Failed CLM Implementation? Here’s the Ultimate Fix

What are the key features to look for in contract management software for finance?

Key features to look for in contract management software for finance include contract tracking, automated alerts for key dates, customizable reporting, integration capabilities with existing software, e-signature support for digital contracts, and secure cloud storage for easy access and collaboration, especially regarding contract entry.

Contract management software for finance designed specifically for finance offers a range of benefits to streamline operations and improve efficiency. By providing a clear record of agreements and preventing confusion from multiple versions, it enhances transparency and reduces errors in contract terms. The intuitive interfaces make it easy for users to navigate the system, locate agreements, and generate reports effortlessly, ultimately increasing user adoption within the organization.

Automated reminders for crucial dates like renewals or payment deadlines play a vital role in preventing missed deadlines and potential financial losses. Integrating contract management software for finance with existing financial operations is essential for maximizing its utility.

What are the Benefits of Volody for Financial Institutions?

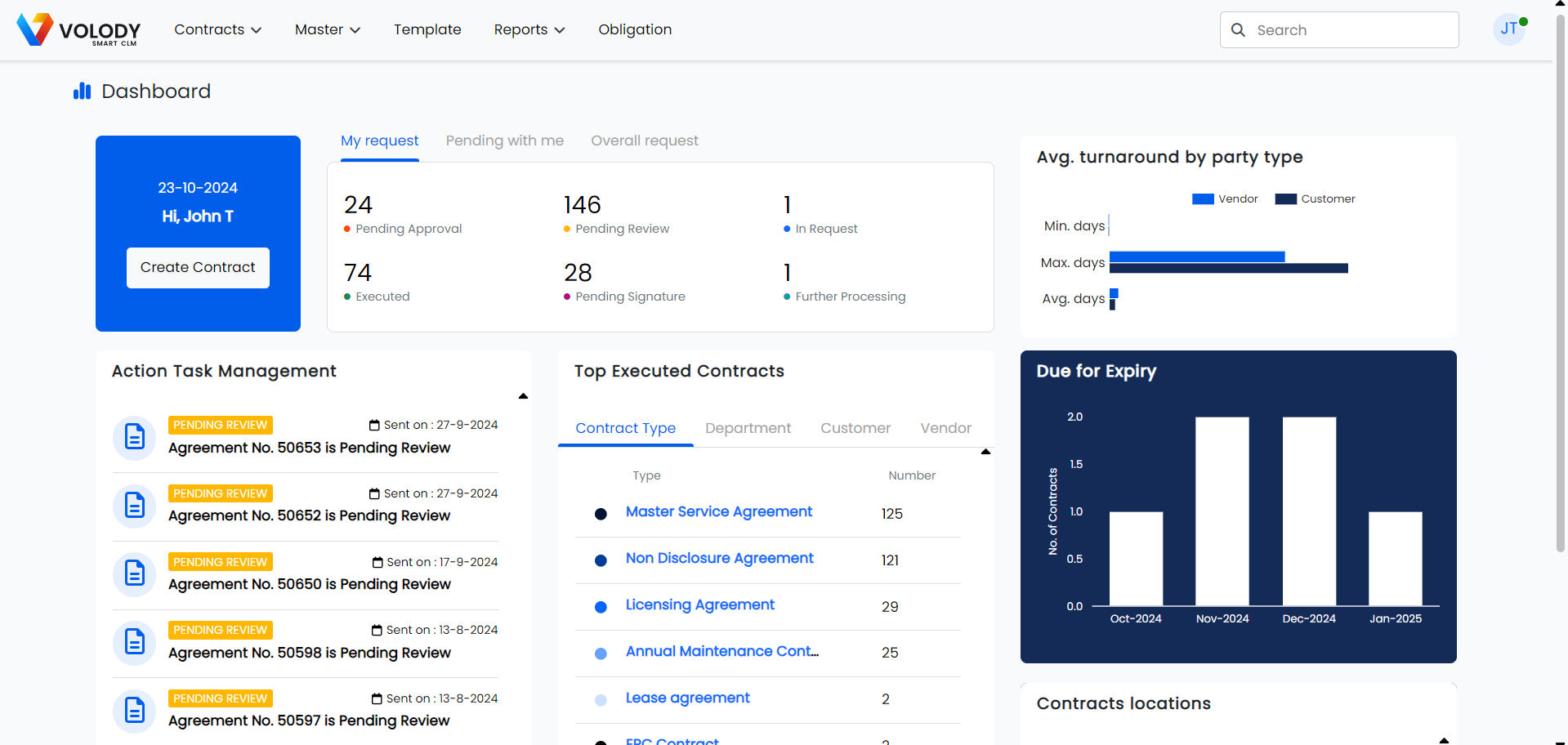

Volody helps financial institutions by offering many unique benefits of contract management software. Its AI features automate agreement review. This means it quickly pulls out important information and spots potential risks, including specific clauses that ensure all relevant data is considered. As a result, teams can analyze agreements faster and more accurately. This cuts down on manual work for legal teams and speeds up the agreement process.

Volody also gives you customizable dashboards and reporting tools. These tools provide real-time information on how agreements are doing and their compliance status. With this information, you can make decisions ahead of time, improve contract negotiations, and find areas to get better in contract management.

Case Study with Volody

A top investment bank used Volody’s contract management platform. This change helped them work better and save money. Before they had Volody, the bank had a hard time managing agreements by hand. This caused problems and increased the risk of not following rules.

|

Challenge |

Solution |

Results |

|

Manual processes |

Automated contract workflows |

90% reduction in processing time |

|

Compliance risks |

Real-time compliance tracking |

100% compliance rate |

|

Limited visibility |

Centralized contract repository |

Improved contract visibility & reporting |

|

Lengthy approvals |

Electronic signature integration |

Faster contract execution |

Volody helped the bank by making contract workflows easier to manage. By using a central contract management platform, the bank could work better. This change reduced risks and made things more efficient.

Related Article: What is an Automatic Contract Renewal Clause? Detailed Guide

Beginner’s Guide to Setting Up Contract Management Software

Setting up contract management software, including contract software, can be simple. With good planning and the right steps, you can fit this important tool into your work easily. This section gives you a clear plan. It begins with what you need to start with a contract management solution. Then, it will help you through each step of the setup process.

What You Need to Get Started

Before you select a solution, assess how you currently manage agreements. Look for problems and areas where you can improve. Think about your specific needs. Consider the types of agreements you handle, how many users need access, and any software you want to connect with. Set your budget and your goals for return on investment (ROI) to help you choose the right software.

- Look into different contract management software options.

- Compare their features and how easy they are to use.

- Check the reputation of the vendors and their customer support.

- Look at the pricing of each option.

- Most importantly, ask for demos and trials.

- This will help you test the software yourself.

- Make sure it fits your needs and workflow.

Step-by-Step Guide to Implementing Your Solution

Once you choose the best solution, stick to a clear plan to make it happen. Begin by setting specific goals and a practical timeline. Include important people from the start to get their feedback and help with a smooth change. Moving data from old systems to the new platform is a vital step. Plan this process carefully to keep the data safe and avoid problems.

Step 1: Assessing Your Current Contract Management Processes

A good start to success is knowing where you are now. Take a close look at how you manage agreements. Write down each step in the contract lifecycle, from making and negotiating agreements to carrying them out and renewing them. Talk to team members who work with agreements every day. Their thoughts and ideas can help you see problems.

- Identify problems or delays in your current work process.

- Are you losing or delaying contracts?

- Are approvals taking a long time?

- Do you notice repeated mistakes in contract data?

- By knowing these issues, you can focus on important features and changes when setting up your software.

Step 2: Choosing the Right Contract Management Software for Finance

With a good understanding of your needs and problems, you can begin looking at contract management software for finance options. Check out different vendors and compare their features. Think about how easy they are to use, their security, how well they integrate with other systems, and the support they offer to customers.

- Ask for advice from people in your industry or talk to tech experts to use their knowledge.

- Ask for demos and trial versions of the software you are interested in.

- Trying out the software helps you see how it works and if it looks good.

- This experience helps you check if the software fits your team’s skills and what they like.

Step 3: Customizing the Software to Fit Your Needs

Once you pick your software, customize it to fit your organization’s needs. Set user roles and permissions to manage access levels and protect data. Create automated workflows for contract approvals, reviews, and renewals. This will help streamline tasks and cut down on manual work.

- Customize templates for each type of agreement. This helps keep things the same and saves time on contract drafting.

- Upload your current agreement data into the system. Make sure it is organized and easy to find.

- Regularly back up your data. This will help prevent loss and keep your business running smoothly.

Step 4: Training Your Team on the New System

Effective training is crucial for successful software adoption. Make sure to give thorough training to everyone on the team who is part of the contract management process. Customize the training materials and sessions to fit the different user roles and skill levels.

- Teach more than just how to use the software. Show the best ways to create, negotiate, and manage agreements in the system.

- Encourage practice during training sessions. This helps team members feel comfortable using the software in a safe space.

- Offer continuous support and resources. This way, team members can get help with any questions or problems that come up.

Step 5: Managing and Maintaining the System

Implementing the software is only the first step. Ongoing management and care are important for long-term success. One must:

- Regularly check and change user permissions and access rights when roles or responsibilities change.

- Keep checking how well the software solves your main problems and makes contract management easier.

- Regularly review your agreement data to ensure it is accurate and follows all rules.

- Ask your team for feedback often to spot any areas that need improvement or changes.

Related Article: Ultimate guide of Contract Repository Systems

Conclusion

In conclusion, CLM is very important for improving financial workflows. By using strong contract management software for finance like Volody, financial institutions can make their operations smoother and work more efficiently. It also helps them adjust to rules and changes easily. The special benefits of Volody meet the needs of the finance sector. This makes it a smart choice for handling agreements well. With the right setup and integration, Volody helps businesses deal with the usual challenges and improve their contract management methods. Embrace the future of financial operations with Volody CLM.

FAQs

How Do I Migrate Existing Contracts to a New Management System?

Migrating your current agreements is usually helped by the contract management solution you pick. This process often includes bringing in agreements from shared drives or current contract storage. You can also add suitable tags to keep everything organized easily. Using features like digital signatures can help keep things consistent and valid legally.

Can Contract Management Software Help with Compliance and Audits?

A good contract management software for finance helps you keep track of important dates and deadlines. This helps you follow the rules at every stage of the lifecycle with contract management software for finance software. It keeps the agreement safe and lets you manage different versions easily. This makes audits easier to handle. With electronic signatures, you can also see how things are moving along with your commitments. This creates a clear and ready-to-audit system.